Fix n Flip Loans

Whom are Fix & Flip Loans Suited For?

Types of Properties We Fund

How do Fix & Flip Loans Get Financed?

We fund LLC’s with borrowers even if they have not completed any flips. If you have flipped 5 properties in the past 24 months you benefit with lower rates. Lender underwriting is based on rehab experience, credit, amount of $$ for the rehab and after repaired value. Our focus is to understand your business. These loans are non conventional loans that do not require any income or employment.

Minimum score of 600+ and a $75,000 loan amount. Once you have filled out an application and been pre-qualified for your loan you will need to provide specific documentation.

Fix & Flip Program Criteria

To get a Fix and Flip loan started you will need:

- Zero Fix & Flips completed in the last 24 months

- A 600+ minimum score

- $75,000 – $5,000,000+ investment property (1 to 4 Units)

- Purchase contract

- 2 months of recent bank statements

- Score and background check

Terms

- Max LTV 75% of after repaired value & 100% rehab

- Rates from 6.49%

- 9 to 24 month flexible terms

- Interest Only

- No prepay penalty

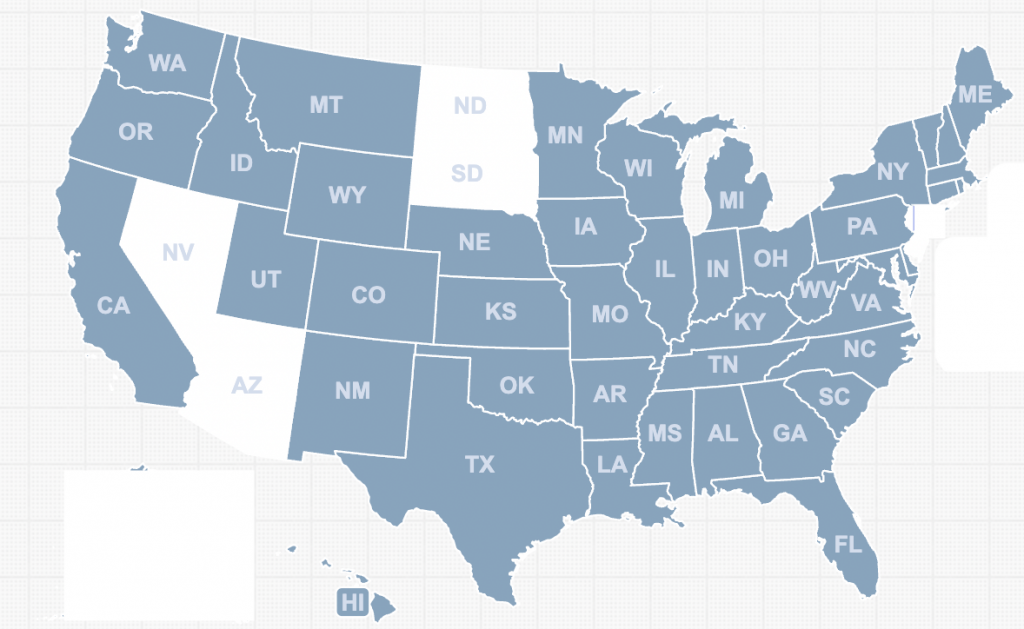

States We Lend

AK AL AZ CA CO CT DE FL GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS MT NC NC NE NH NM NY OH OK OR PA RI SC TN TX UT VA VT WA WI WV

Recent Deals

Cleveland, Ohio

February 2022

Loan Type: Fix and Flip

Loan Amount:

LTC: 75

Canon, CA

January 2022

Loan Type: Fix and Flip

Loan Amount: 1,450,000

LTC: 85

Menifee, CA

February 2022

Loan Type: Fix and Flip

Loan Amount: 340,000

LTC: 90

Santa Barbara, CA

January 2022

Loan Type: Long Term Rental

Loan Amount: 380,000

No Income Documentation

40 Year Interest Only

Oceanside, CA

December 2021

Loan Type: Long Term Rental

Loan Amount: 300,000

No Income Documentation

30 Year Fixed

Pico Rivera, CA

January 2022

Loan Type: Long Term Rental

Loan Amount: 502,000

No Income Documentation

40 Year Interest Only

Sarasota, FL

January 2022

Loan Type: Fix and Flip

Loan Amount: $290,000

LTC: 90

Yuba City, CA

January 2022

Loan Type: Long Term Rental

Loan Amount: 238,500

No Income Documentation

40 Year Interest Only

Indio, CA

Loan Amount: $1,825,000

LTC : 73%

Indio, CA

Loan Amount: $1,825,000

LTC : 73%

Indio, CA

Loan Amount: $1,825,000

LTC : 73%